How is student loan interest calculated is vital for effectively handling your student debt. Interest significantly impacts the total amount you’ll pay throughout the duration of your loan, making it important to understand how it operates. In this guide, we will simplify the process of calculating student loan interest and highlight the factors that influence the amount of interest you accumulate. Whether you have federal or private loans, understanding how interest functions will assist you in devising a repayment plan that reduces your overall expenses.

What Is Student Loan Interest?

Before we get into the details of how student loan interest is determined, let’s cover the fundamentals. Interest is essentially the fee you incur for borrowing money. For student loans, this means the extra amount you pay on top of the principal, which is the initial loan sum. Lenders impose interest to offset the risk involved in lending money.

When you ask, ‘how is student loan interest calculated?’ remember that the method depends on the type of loan you have and the terms in your agreement.

Types of Student Loan Interest Rates: Fixed vs. Variable

When discussing student loans, you’ll encounter two types of interest rates: fixed and variable.

Fixed Interest Rate: This type of rate remains constant throughout the duration of the loan. Most federal student loans come with fixed rates, ensuring that your interest rate won’t fluctuate as time goes on.

Variable Interest Rate: This rate can change at intervals, depending on market conditions. Private loans frequently have variable rates, which could lead to either lower or higher interest costs as time progresses.

How Is Student Loan Interest Calculated?

Lenders usually calculate interest on student loans daily using simple interest, not compound interest. This means they base the interest only on the principal amount, without including any previously accumulated interest. However, in specific cases, lenders may capitalize the interest.

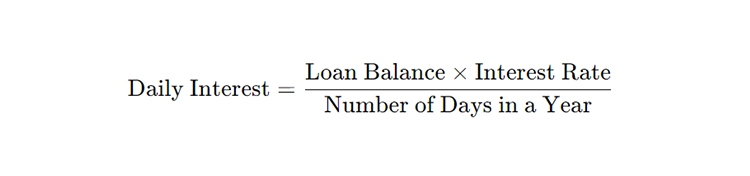

The basic formula for calculating student loan interest is:

The formula for calculating student loan interest is:

Here’s a simplified explanation:

- Loan Balance (Principal): This refers to the total amount you took out or what’s left to pay on your loan.

- Interest Rate: This is the yearly percentage your lender charges, calculated on a daily basis by dividing by 365.

- Days in a Year: To keep things straightforward, lenders typically consider a year to have 365 days.

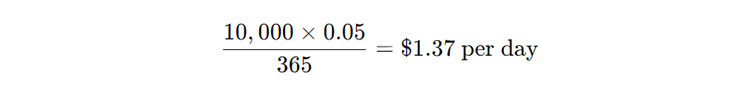

For instance, if your loan balance is $10,000 and the interest rate is 5%, you would calculate the daily interest accrual like this:

In this scenario, your loan accrues $1.37 in interest every day.

How Interest Accrues on Student Loans

Now that we have the formula, let’s explore how it affects your loan over time. Interest on student loans accumulates daily, meaning that each day, a little bit of interest is added to your total balance according to the formula mentioned earlier.

If you pause payments during specific times, like while you’re studying or during a deferment, the interest will keep accumulating. For federal subsidized loans, the government covers this interest while you’re in school or during deferment. On the other hand, with unsubsidized loans and most private loans, you’re responsible for any interest that builds up.

Interest Accrual During Grace Periods and Deferment

Federal loans usually include a grace period of about six months after you graduate, leave school, or drop below half-time enrollment. During this period, you might not need to make any payments, but keep in mind that interest can still accumulate. For federal subsidized loans, the government pays the interest during this grace period. On the other hand, with unsubsidized loans, you are responsible for the interest, which will be added to your principal balance if you don’t pay it.

In addition, if you enter deferment or forbearance—periods when your payments temporarily stop—interest may still accumulate on your loan. Federal subsidized loans offer the benefit of covering the interest during deferment, but unsubsidized and private loans usually do not provide this advantage.

The Impact of Capitalization

One important idea to understand about student loan interest is capitalization. This process happens when any unpaid interest gets added to your principal balance. It typically occurs in certain scenarios, like when you finish a deferment, forbearance, or grace period without settling the interest that built up during those times. Once the interest is capitalized, you’ll start paying interest on a higher loan amount, which can raise your total expenses.

To lessen the effects of capitalization, think about paying off the interest during times when your payments are on hold.

Simple vs. Compound Interest

Many student loans operate on a simple interest basis, which means interest is calculated solely on the principal amount. For instance, federal student loans follow this approach, resulting in daily interest accumulation without charging interest on any previously accrued amounts.

Conversely, some private lenders may use compound interest, applying it to both the principal and the previously accumulated interest This method can lead to a substantial increase in the total amount you owe over time, as unpaid interest can generate even more interest.

How Repayment Affects Your Interest

When you start repaying your loan, your monthly payments usually include both interest and a part of the principal amount. At the start of your repayment term, lenders allocate a larger portion of your payment to interest. As you reduce the balance, more of your payment goes toward the principal. This process is called an amortization schedule.

If you choose to make additional payments or pay more than the minimum required, you can pay down the principal more quickly, which will decrease the total interest you owe over the duration of the loan.

Tips for Reducing Interest Costs

If you want to lower the interest you pay on your student loans, consider these helpful strategies:

- Start making payments during your grace period or while you’re still in school: Even small contributions can decrease your principal balance and stop interest from accumulating.

- Make additional payments: Paying more than your required monthly amount can help you pay down the principal quicker, which in turn reduces the total interest you’ll owe.

- Look into refinancing your loans: If you have a good credit score or a co-signer, refinancing might allow you to secure a lower interest rate, potentially saving you a significant amount over the life of the loan.

Enroll in automatic payments: Many lenders provide interest rate reductions for those who sign up for autopay, which can slightly lower your rate.

Federal vs. Private Loan Interest Calculations

Federal and private student loans calculate interest in similar ways, but there are important distinctions to consider:

- Federal Loans: Generally feature fixed interest rates and utilize simple interest calculations. They come with advantages like interest subsidies for subsidized loans and various income-driven repayment options.

- Private Loans: Can have either fixed or variable interest rates, with some employing compound interest. These loans typically offer fewer protections for borrowers and less flexibility in repayment compared to federal loans.

Conclusion

Understanding How is student loan interest calculated is essential for effectively managing your student debt. Regardless of whether your loans are federal or private, the fundamental formula for daily interest stays consistent. However, the specifics, rates, and advantages may differ. By understanding how interest builds up, you can make smarter repayment choices. Looking into ways to reduce interest will help lower the total cost of your loans. Taking initiative, such as paying off interest early or considering refinancing, can make a big difference. It can greatly reduce the final amount you end up paying.